- Business at the Bedside

- Posts

- Smart Finance for Physicians

Smart Finance for Physicians

Smart Finance for Physicians: Navigating 401(k)s, Roth IRAs, and the Magic of Compound Interest

Dear Doctors and Medical Professionals,

As healthcare professionals dedicated to the well-being of others, it's equally important to focus on your financial health. This edition delves into the realms of 401(k)s, Roth IRAs, and the compelling world of compound interest.

🌐 401(k) Plans: Your Financial Backbone The 401(k) is not just a retirement savings plan; it's a cornerstone of your financial strategy. With contributions made directly from your paycheck and often matched by your employer, the 401(k) stands as a robust tool for tax-deferred growth. It's a foundation, setting you up for a more secure future.

🔥 Roth IRAs: Tax Efficiency in Your Savings Enter the Roth IRA – a powerhouse of tax efficiency. Unlike traditional IRAs, the Roth IRA allows for tax-free growth and withdrawal. You contribute after-tax dollars, letting your investments grow without the looming shadow of future taxes. Ideal for those who anticipate a higher tax bracket in retirement, it's a smart choice for many in the medical profession.

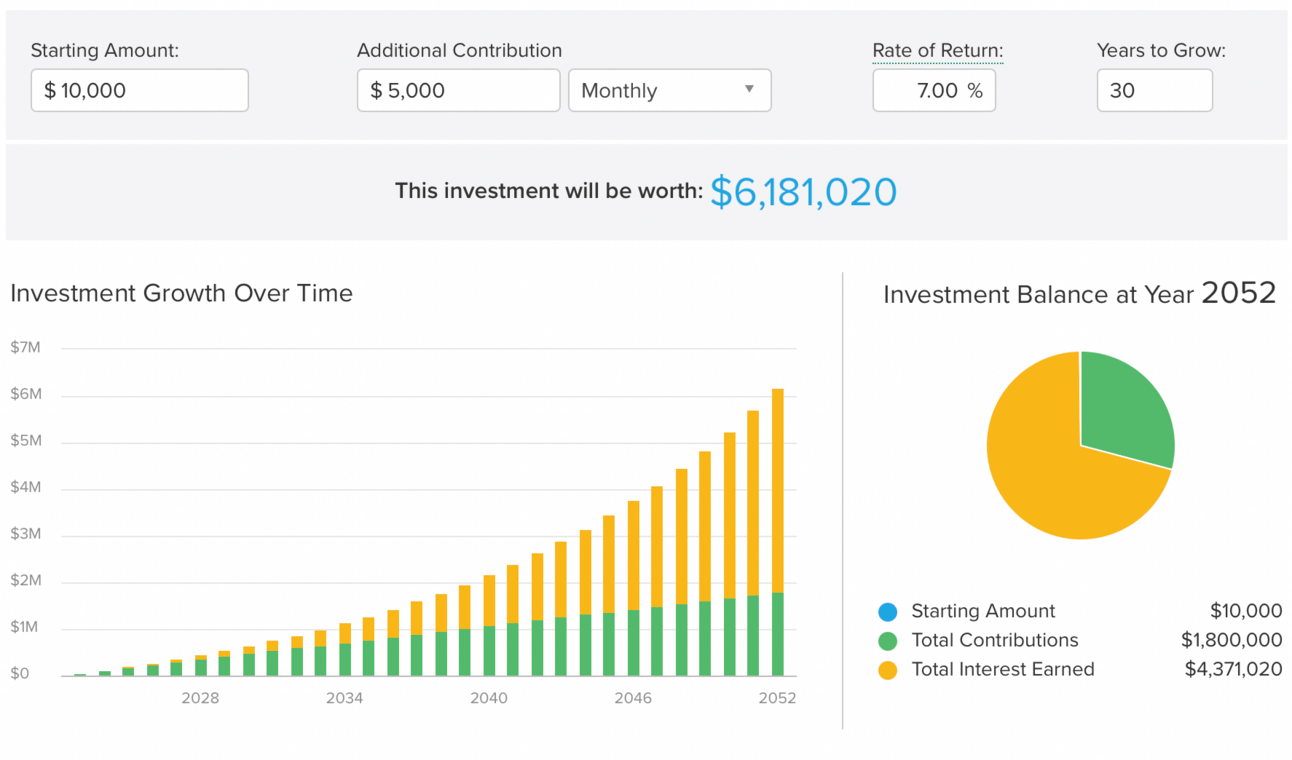

✨ The Magic of Compound Interest Now, let's explore the magic ingredient – compound interest. This isn't just interest on your initial investment; it's interest upon interest, the snowball effect that can turn your savings into a financial avalanche over time. For physicians, starting early can mean the difference between a comfortable retirement and a truly prosperous one. It's about letting time and patience work their magic on your savings, turning each dollar into an industrious worker contributing to your financial future. Check out the graphic below to see the true power of compound interest! You can check out Smart Asset to run your own numbers.

In Conclusion: As you care for the health of your patients, take a moment to nurture your financial well-being. Balancing your investment in 401(k)s and Roth IRAs with the power of compound interest can set the stage for a retirement that's not just comfortable but rich in possibilities. Remember, investing in your future is as important as investing in your career.

Disclaimer: This newsletter is for informational purposes only and should not be taken as financial advice. We recommend consulting with a qualified financial advisor to tailor advice to your unique situation.

To your financial well-being and success,

A.K,MD

Reply