- Business at the Bedside

- Posts

- The 100k Problem

The 100k Problem

A tale of two options

Your first 100k

Congratulations, you’ve been working for a few months and have managed to set aside your first 100k. Now what? Do you go all into the latest meme stock, do you withdraw the cash and hide it under your bed, or do you go out and become the new landlord in your town? It really depends on what you want to do, you’ve earned the cash, so you have the power to do as you please. I can only provide some mock scenarios.

Scenario 1: The stock market investor

Let’s say you choose this route with your first 100k. You choose a low-cost index fund like SPY and decide to capture a piece of the 500 companies that make up the S&P. At this point,t you’re done. You don’t have to lift a single finger, and now you can sit back for the next 30 years and watch your investments grow. This is practically life on easy mode. You open your accounts every month, and the day-to-day ups and downs of the markets have no effect on you.

Scenario 2: The real estate mogul

So you’ve chosen toilets and tenants…Let’s assume you eye a 500k property and park your 100k into acquiring this asset. You leverage 400k from the bank and have 100k of your equity in the property. For argument's sake, we’ll say this property is relatively new, headache-free, and can easily be rented. But you don’t want to be the one managing it, and you prefer life on easy mode, so you hire a property management company to deal with all issues that may arise in the property. Great, you sit back and collect your rent, your property appreciates yearly, and your loan gets paid down with the remaining rent.

Who wins in the end ?

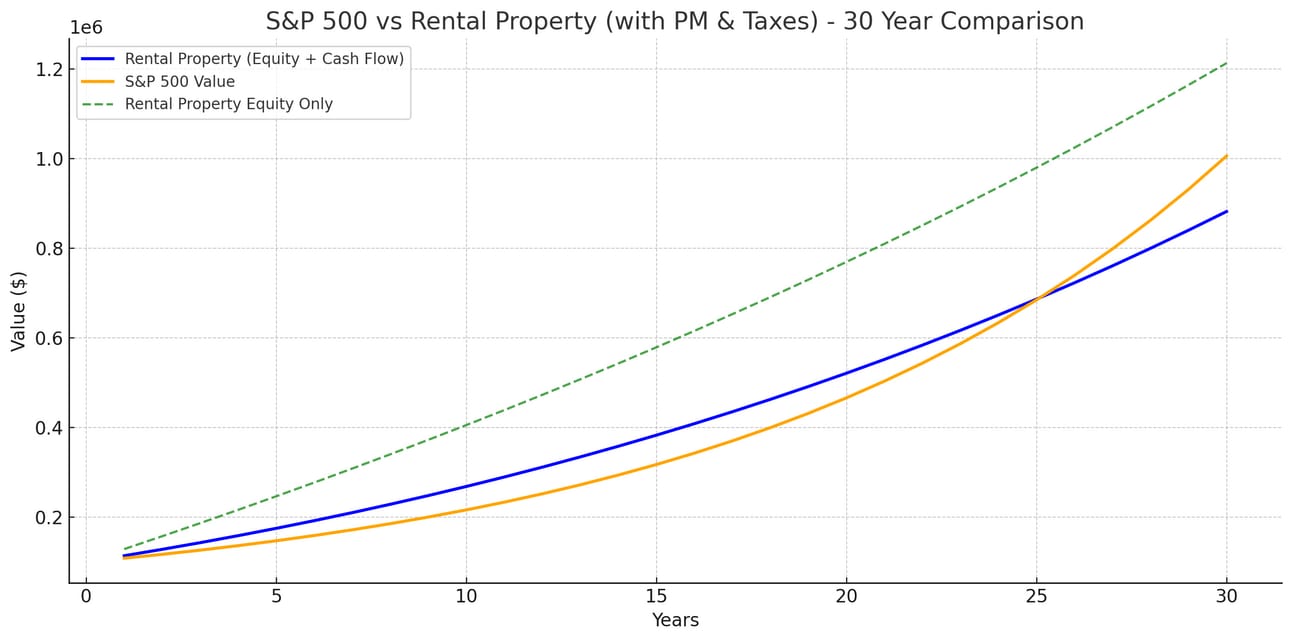

For the stock market investor, the math is relatively simple. At the end of 30 year,s assuming an average 9% return with an initial investment of 100k and nothing more you would expect to have approximately 1.47M at the end. Through the 30-year journey, you would have done nothing to manage the portfolio.

The case for the real estate investor is slightly less linear. At the end of 30 years, we can at least assume that the mortgage loan has been paid off. Taking into consideration monthly cash flow and taking away expenses and accounting for variables including vacancies and unexpected expenses, the real estate mogul would be pocketing approximately 1.2 M. This scenario also took into account an average 3% increase in real estate value year over year.

But it’s more complicated than that

Another aspect that we didn’t take into consideration is depreciation and tax benefits that owning real estate can provide, which the stock market doesn’t necessarily offer. On paper, parking your 100K into the stock market for 30 years doesn’t sound like a bad idea. It seems like a better idea. There are ways to increase the value of real estate and cash flow through short-term rentals and high ROI renovations; however, that becomes more complicated for the average investor.

S&P vs Rental property

What would you choose?

At the end of the day, this is not financial advice, and I am not a financial advisor. What you choose to do with your hard-earned dollars is up to you. I have seen people do extremely well in both scenarios. It comes down to your experience, comfort, and knowledge based on how you wish to grow your wealth!

To your success,

A.K MD

Reply